PV = 100 $ You get: 100.5 $, lets arise N to 5: You get: 102.53 $ (Oh, maybe 3 Cent more then expected, but evereything is alright).Īnd what happen with N = 12 (all other variables are the same)?: What happen if you use P/Year = 12 and N = 1: First your calc divide the I/year with 12 and calculate the amount of cash after one month.Įxample: P/Year = 12, N = 1: I/year = 6 % : the calculated Interest Rate is 0.5 % (for one month). The I/year is based on one year, if you use P/Year = 1 the your amount your Interest Rate of I/year match to the year. Press and hold the first key from the left ( N) and the first key from the right ( FV) on the top row.

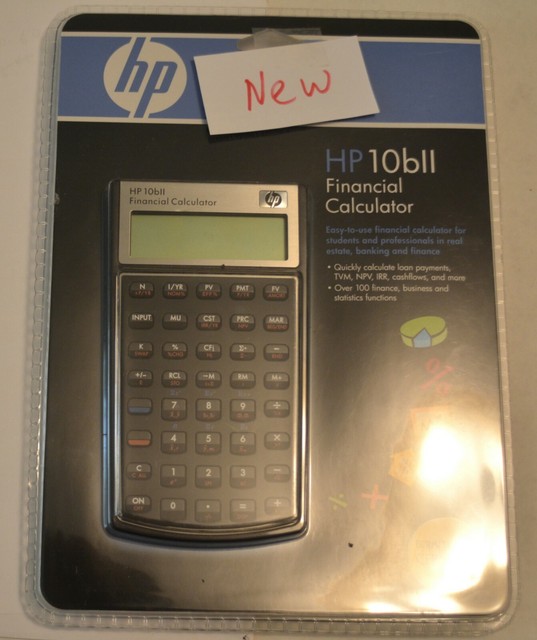

To completely reset the calculator and erase all user memory, follow the procedure below. N get the meaning from P/Year: P/Year = 12 then N = 5 means five month or Resetting the calculator using the keyboard. Last for first: P/Year = 1 You are calculating the interest rate in a year one time, =12 every month, = 365 every day P/Year = How often in a year the Interest Rate calculated (and added/subtracted to the loan). Your second post seems to me, that you probably don't understand the game of the three variables: This should give you the correct result.Ĭyrille gave you the right advise. What you need to do is change the number of payements per year to 1 (and you might also need to change the number of compounding per year to 1, but I am not sure, and I do not have a 10BII+ in front of me to test). HP 10bii+ Business Calculator 1429 Review this product R799.00 7990 7990 Whether you are a student or a practicing professional, the fast and powerful HP 10bll+ makes it easy to solve business, financial, statistical, and math calculations accurately and quickly, at a price that everyone can afford. Simlply changing N in 24 will not help because you would be doing calculations based on a nominal interest rate (10%), which correspond to an effective interest rate of 10.47%! So you need to be carefull of this issue. Ie: I/YR and N work on different units of time. The problem is that the calculator (like all other financial calculators) is setup to do calculations based on a Nominal and Anual interest rate (based on 12 compounding per year), and 12 payements per year (which N is). The exercise that you are trying to solve (I think, based on the expected result) is for the Future value of an investmenet of 100, at 10% annual, effective interest rate, for a period of 2 years (which is 121). Your calculator is correct, the Future value of an investmenet of 100, at 10% annual, nominal interest rate, for a period of 2 month is 101.67. Business PCs, Workstations and Point of Sale Systems.Printer Wireless, Networking & Internet.DesignJet, Large Format Printers & Digital Press.

Hp 10b financial calculators plus#

Hp 10b financial calculators upgrade#

A great investment that can grow with your needsSuitable for multiple courses - from introductory business, finance, accounting, real estate, and banking to mathematics, science and statistics.Ideal for exams: intuitive keyboard layout and minimal keystrokes for many common functions. Meets exam requirementsSAT, PSAT/NMSQT, and College Board AP (Advanced Placement) Tests.Store up to 22 numbers in memory registers for later use. Get immediate results with no waiting for complex calculations. View answers with up to 12 digits of accuracy. Fast and powerfulDesigned with powerful finance, business and statistical operations.Maintains keystrokes of the HP 10bII while adding 10 types of financial and statistical calculations. Easy-to-learn and useDedicated keys provide fast access to common financial and statistical functions.

0 kommentar(er)

0 kommentar(er)